HSAs solve a problem, but not the problem.

Republicans are enthusiastic! From many of them I’ve heard about Health Saving Accounts. It’s not that hard to control health care costs, they say. Just reconnect health care consumers to their spending. Most recently, Dr. Ben Carson weighed in, even suggesting that the government simply fund people’s HSA to the tune of $2000 per person. I’m told that support for HSAs is an important plank in the (possibly mythical) “Republican healthcare plan.”

What’s an HSA?

An HSA is a pre-tax account into which you and/or your employer can put money reserved exclusively for health care costs. It might work like this: In lieu of traditional health insurance for minor medical expenses, your employer might provide you with an HSA to which she contributes. You could also put money into your account yourself. The first health care costs incurred that year would be paid out of your HSA. Once the HSA is exhausted, you, the employee, are responsible for paying medical bills directly. An HSA is usually coupled with a major medical insurance plan with a high deductible so that beyond several thousand dollars in medical bills, a traditional insurance plan kicks in.

An employer once offered this to my family. We paid a portion of our premium and got $2000 at the beginning of each year added to our HSA. From this account, we paid the full cost of all our medical expenses–doctor visits, medications, etc.. No copays or cost-sharing. Your HSA pays it all. If expenses got high enough, this account would run dry. After that point, we would pay all expenses out of pocket. To protect us on the high side, the plan included a major medical policy which would begin to cover expenses beyond about $4500, just like a standard insurance policy with a high deductible. You might think this was some scheme by my ruthless employer to cheat us out of health care, but my engineer co-workers and I all agreed. There was no scenario in which this plan would cost employees more than the old plan. If you go to the doctor once for $250, you pay less than the old plan. If you get cancer and rack up $600,000 in bills, you still pay less than the old plan. And for every point in between those two, the new plan was still less expensive for employees.

An employer once offered this to my family. We paid a portion of our premium and got $2000 at the beginning of each year added to our HSA. From this account, we paid the full cost of all our medical expenses–doctor visits, medications, etc.. No copays or cost-sharing. Your HSA pays it all. If expenses got high enough, this account would run dry. After that point, we would pay all expenses out of pocket. To protect us on the high side, the plan included a major medical policy which would begin to cover expenses beyond about $4500, just like a standard insurance policy with a high deductible. You might think this was some scheme by my ruthless employer to cheat us out of health care, but my engineer co-workers and I all agreed. There was no scenario in which this plan would cost employees more than the old plan. If you go to the doctor once for $250, you pay less than the old plan. If you get cancer and rack up $600,000 in bills, you still pay less than the old plan. And for every point in between those two, the new plan was still less expensive for employees.

Market-based savings

So why did my employer make this change? The idea is that employees will pay attention to the cost of their health care and that alone will reduce costs. And it worked, at least on a personal level. We started asking, “How much does that cost?” and “Could we give it another day before seeing the doctor?” We didn’t have any major expenses while under that plan, but if we did, I think I would have asked “Is that the cheapest MRI, or just the closest?” This is where the GOP puts their faith. Unsurprisingly, they count on shrewd consumers in the free market and the responses of equally clever suppliers to bring prices down and quality up. So, is your blowhard Republican roommate right?

But not where we need it most

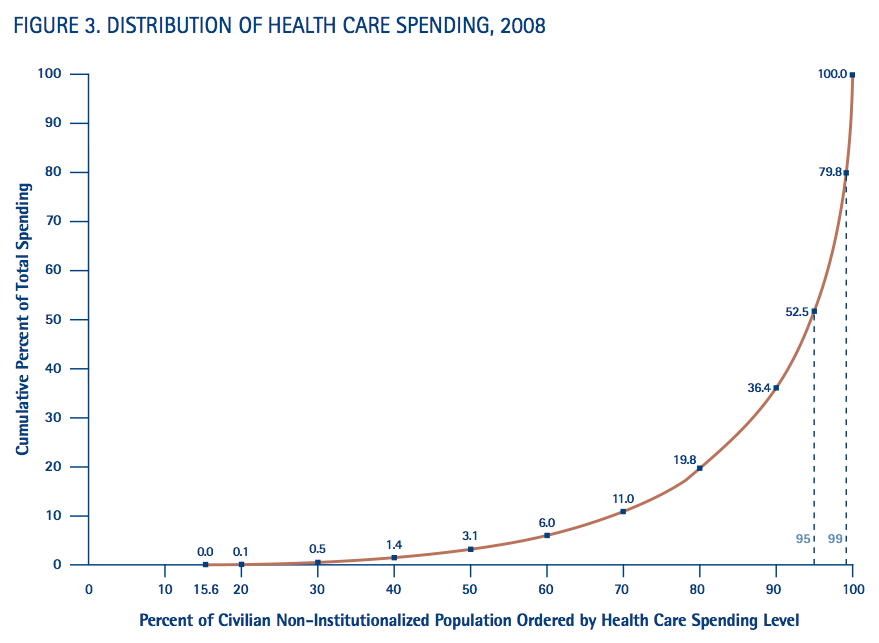

Unfortunately not. HSAs are effective at controlling costs for small medical bills, but America’s problem is at the other end. We’re spending over half of our health care dollars on just 5% of patients. Those people have long exhausted any reasonable HSA. Meanwhile, the bottom 50% of spenders, those still spending money out of their HSA, account for just 3% of all health care spending. Probably HSAs will affect almost none of the top 20% of health care spenders which account for 80% of health care spending. This graph, borrowed from NIH, shows this effect quite clearly. On the lower axis is the percentile rank according to health care spending. The vertical axis is the fraction of health care dollars spent on everyone below that percentile rank. So, when we see that the 40th percentile has the value of 1.4%, we know we spend 1.4% of our health care dollars on the healthiest 40% of patients. The steepness of this curve indicates that the spending addressed by HSAs is a very small portion of total spending.

Health care is classically, almost pathologically, unsuited to a free market. Demand is inelastic. Information is asymmetric. And the numbers are so far beyond people’s experience, that we have great trouble assessing risk and valuing the different health care products. This problem just gets worse for more expensive treatments and, as shown in the graph above, that’s where the problem is. Even if HSAs dramatically reduced costs for the 80% of us whose costs fall under their major medical deductible, we’d still go bankrupt unless we find a way to control costs for that top 20% who’ve exhausted their HSA and have no personal incentive to control costs.

So, even without asking whether convincing people to postpone their colonoscopy or shop for the cheapest throat culture is really a net savings, we can conclude that HSAs are ignoring most of the problem. That doesn’t mean HSAs are a bad idea, but they are, at best, window dressing for anything aspiring to be called a “health care plan.”