Ben Howe says today’s GOP is different from GOP circa 2006–that we should stop holding the budget-busting, war-mongering actions of Bush-era Republicans against today’s fiscally responsible, TEA party Republicans. This is not your father’s GOP. This idea is getting some traction. There is some wishful thinking out there that this time your vote for Republicans will mean smaller government despite the fact that the last Republican President to reduce either federal spending (adjusted for inflation and population) or the budget deficit was Eisenhower.

There’s a part of me that would like to believe in the sincerity of GOP rhetoric. I do worry about a government that allocates fully a quarter of everything produced in the country. But, I’m skeptical not just because the faces at the top of the GOP have not changed. I believe people can change. The problems is the incentives for GOP legislators have changed very little since 2006. When a politician (of any persuasion) pays lip service to a policy you like, it’s important to consider how the stake holders feel about it and how they’re liable to react politically. Here are three good conservative ideas which the GOP has no chance, or indeed intention, of accomplishing.

Raising the retirement age (or other Social Security fixes). You know and I know that it’s ridiculous to pretend people aren’t staying healthy longer or that Social Security isn’t approaching a precipice. Without any changes, the trust fund (i.e. the surplus accumulated by payments into Social Security, also the money loaned to the treasury to fund our government these 20 years) is predicted to be exhausted in 2033. At that point (or some time before), Social Security must either cut benefits by an average of 23% or begin collecting more money. To listen to them, you’d think the GOP were making this top priority. But today’s Republicans have no hope, or even inclination to make substantive changes to the Social Security. The reason for this is that Republican electoral success increasingly relies on strong majorities among retirees to compensate for their poor showing among younger age groups. The Democrats enjoy an advantage among registered voters in every age category except the over 65 crowd. Candidates on the Left who openly advocate raising the retirement age or trimming benefits regularly face attacks from the Right. Most of us remember Mitt Romney’s criticism of the President’s 700 billion dollar reduction in Medicare spending. The Washington Post highlighted more such attacks against Democratic candidates by Karl Rove’s American Crossroads. Until Republicans find a demographic to replace retirees, all Republican entitlement reform is dead on arrival. You heard it here first, when it comes to fixing Social Security, the GOP will sell you, hard-working taxpayer, out to their AARP base in a heartbeat.

Eliminating mortgage interest deductions. This is a great Republican idea. The mortgage interest deduction is a giveaway to home owners and shifts the tax burden to poorer renters. It drives up home prices, complicates tax filing and distorts the market unnecessarily. But the GOP can’t do it. They take too much money from the people most harmed by this policy. The third largest individual donor to Mitt Romney, post TEA party revolution candidate for President, was Texas real estate developer, Bob J. Perry. He gave $15 million to the Romney campaign. Real estate interests gave three times more money to the Romney campaign than to the Obama campaign. Aside from investment professionals, real estate was the industry most supportive of Romney’s candidacy. The National Association of Realtors is a powerful organization which spends $40 million on lobbying every year. They support candidates on both sides including GOP House Candidate Mia Love and Democratic Senate candidate Mary Landrieu. Until money no longer rules politics, the mortgage interest deduction is here to stay.

Reducing agricultural subsidies. No one but the recipients of farm subsidies thinks they’re a good idea. The Department of Agriculture directly pay about $19 billion each year to American farmers, large and small, in the form of subsidies to crop insurance premiums and direct crop price support. Recipients include Jon bon Jovi, Rockefeller heirs and 1500 residents of New York City. Subsidies to US farmers harm third world agrarian economies which could be lifting themselves out of poverty while providing cheaper groceries for American consumers. Countries around the world hold this up as an example of the US’s protectionist trade policy and our hypocrisy as we ask countries like China to open their markets to foreign goods. Cutting these subsidies gets some play on conservative talk radio and in conservative think tanks. But it’s a non-starter among Republicans who actually govern. President Obama’s 2014 budget includes some cuts to these which Republican lawmakers have resisted. The Republican Study Committee recently uninvited the influential conservative Heritage Foundation to its meetings over Heritage’s support for reducing farm payments. Again, Republicans have both a demographic and a fund-raising problem. They enjoy broad support from rural communities and states whose voters, even when they don’t receive subsidies themselves, identify with the image of the struggling Midwest farmer. It also brings in the dollars. Campaign contributions by agribusiness has increased five-fold since 1990 with 71% of contributions going to Republicans. An estimated $150 million is spent on lobbyists for agricultural industries every year. In 2007, facing reductions to farm subsidies spearheaded by Democrats, 3000 lobbyists flew to Washington and killed changes to the farm bill. The farm lobby has even helped write provisions that enable US farmers to trade with embargoed countries like Iran.

Don’t misunderstand me. Democrats also are crazy to oppose these sensible proposals and electing Democrats is only slightly more likely to make these reality. But they have other policy objectives that are both possible and sensible like immigration reform, expanded infrastructure spending and health care reform. In the GOP playbook, I see only stupid ideas (aggressive foreign policy, balanced budget amendments, etc.) or smart but impossible ideas like those above. A realist must confront the fact that America can expect more of 2003 from today’s GOP. What Republicans can do is start wars. It’s a thing they believe in and that their base can get behind. It plays well with their demographics and brings in campaign contributions from military contractors. As previously discussed, in Republicanland, the Law of Unintended Consequences doesn’t apply to foreign policy, so there’s very little downside.

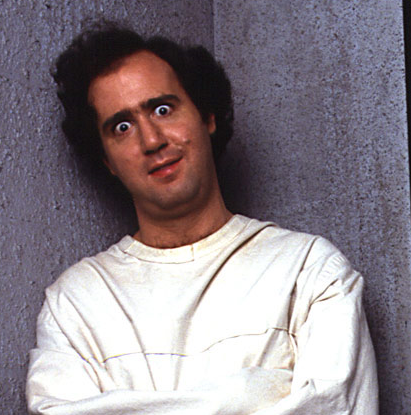

Meet the new boss…